Still Using Spreadsheets to Track Tax Compliance?

Tax Trove helps small SA firms replace chaos with control — so you can stop chasing deadlines and start running a calmer, more profitable business.

Starting from just R285.00 per month.

If You Run a Small Practice, You Know the Feeling...

❌ You miss deadlines and risk penalties or lost clients

❌ You waste away non-billable time on admin overhead

❌ You spend hours digging through spreadsheets and emails

❌ You're never quite sure what’s been done - or not.

Deadline Dread

The nagging worry that a critical SARS or CIPC deadline will slip through the cracks, risking penalties and your professional reputation.

Spreadsheet Chaos

Tracking compliance across scattered, colour-coded Excel files that are one "Save As" error away from complete disaster.

Chasing Clients

Wasting billable hours chasing status updates and chasing clients for documents, instead of billing hours or growing your business.

...There's a Better Way to Run Your Practice.

Introducing

Tax Trove

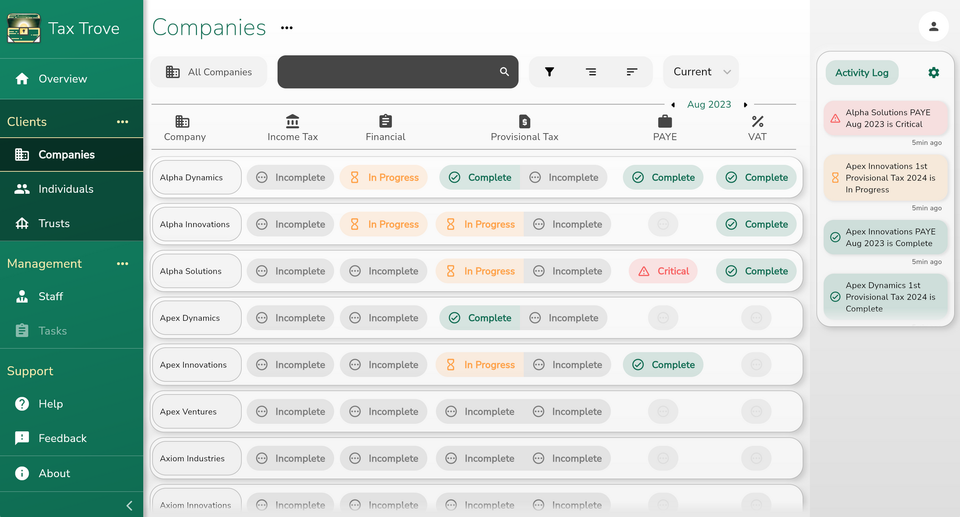

One Platform to Centralize Your Practice, Starting with Compliance.

With Tax Trove you can...

Delegate with

confidence

No more “Did we do EMP501 for this one yet?”

Assign tasks, see progress, and stop second-guessing your team.

Impress

clients

Deliver work quicker and more accurately - without dropping the ball or sending last-minute apologies.

Waste 50% less time

on admin

Stop losing non-billable hours to spreadsheets, chasing updates, or digging through emails.

Take on

20% more clients

When your processes are tight, your capacity grows.

Scale with confidence, not chaos.

Your 4-Step Path to Calm & Control

2

Choose your plan

Select the right package based on your practice size and workflow needs.

3

Import your clients

Bring in your client data quickly using our import wizard.

4

Onboard your team

Link your staff, assign clients, set permissions, and align your team around one system.

Hi, I'm Chanelle de Haan, Co-founder of Tax Trove

I Built Tax Trove Because I Was Drowning Too.

"For over 18 years, I've run my own accounting firm. With hundreds of clients, I was managing it all with crossed fingers—until a staff member saved over the wrong file... and everything collapsed.

My practice couldn’t scale, or stay sane, using tools that weren’t built for accountants.

I knew there had to be a better way. So I partnered with a developer to build the simple, powerful tool I couldn't find anywhere else. Now, I want to share it with you."

– Chanelle De Haan, Tax Practitioner (SAIPA) & Co-Founder of Tax Trove

Testimonials

Trusted by Forward-Thinking Firms Across South Africa

Rezelle Robinson

Robinson Accounting Solutions

SAIPA Professional Accountant (SA)

"I've been using Tax Trove for a while now, and I couldn't be happier with it. This software has truly transformed the way I manage my clients' due dates, what has been submitted and what still needs to be done. Its user-friendly interface and powerful features have made my life a lot less stressful and much more efficient. I highly recommend it to anyone looking for a reliable and effective accounting admin software solution."

Alban Solomon Xolani Demadema

DEM Chartered Accountants Inc.

CA(SA), CA(Z), RA(SA), RPA(Z)

"Tax Trove has streamlined the process of tracking the tax status and compliance of our clients. We now have a centralized hub where we can get a quick overview of what is due and what tax tasks are critical, giving us accurate insight that in turn gives us a better idea of how to delegate tasks in the office based on priority."

FAQs

You Might Be Wondering…

Is my client data secure?

Yes. Your data is encrypted at rest and in transit, stored securely in the cloud, and regularly backed up. We follow best-practice security protocols to keep your clients' info safe.

Do you offer support or training?

Yes. You can book a personal onboarding call with Chanelle or a team member to walk you through setup. If you need help at any point, you can reach out anytime via our dedicated support email: support@taxtrove.co.za.

How does the pricing work?

Tax Trove is a monthly subscription service starting from R285.00 pm - no contracts, no hidden fees, and you can cancel anytime.

Choose a plan that fits your firm’s size and needs.

All plans are billed monthly and include free updates + dedicated support.

What makes Tax Trove different from generic task tools or spreadsheets?

Tax Trove is built specifically for South African tax accountants - not adapted project tools. Tax Trove helps you track SARS and CIPC deadlines, link client entities, manage staff permissions, and help you see exactly what’s been done (and what hasn’t). It's your compliance control center - not just a to-do list.

Still have a question?

Don’t worry - we know switching systems can feel overwhelming. Drop us a message or hop on a quick call with Chanelle. We'll guide you through it.